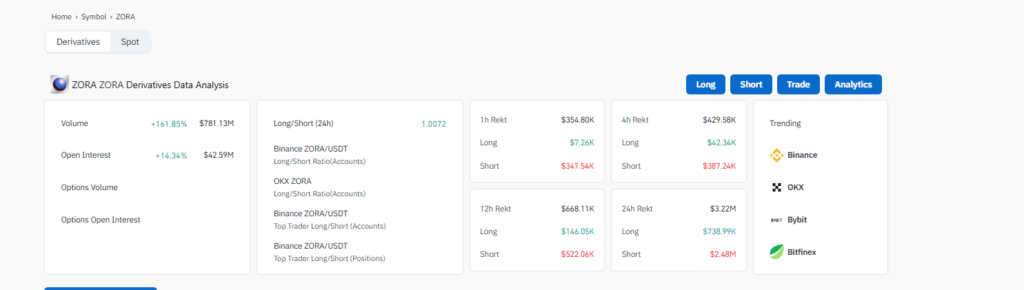

AAVE daily fees skyrocket 200%, signaling lending market recovery

- Aave’s daily fees increased by around 200% within the last three months.

- They hit multi-month peaks of over $3 million per day, indicating intensified borrowing.

- The surge reflects reinvigorated DeFi lending interest.

Aave continues to dominate the DeFi lending market, this time attracting attention with serious figures.

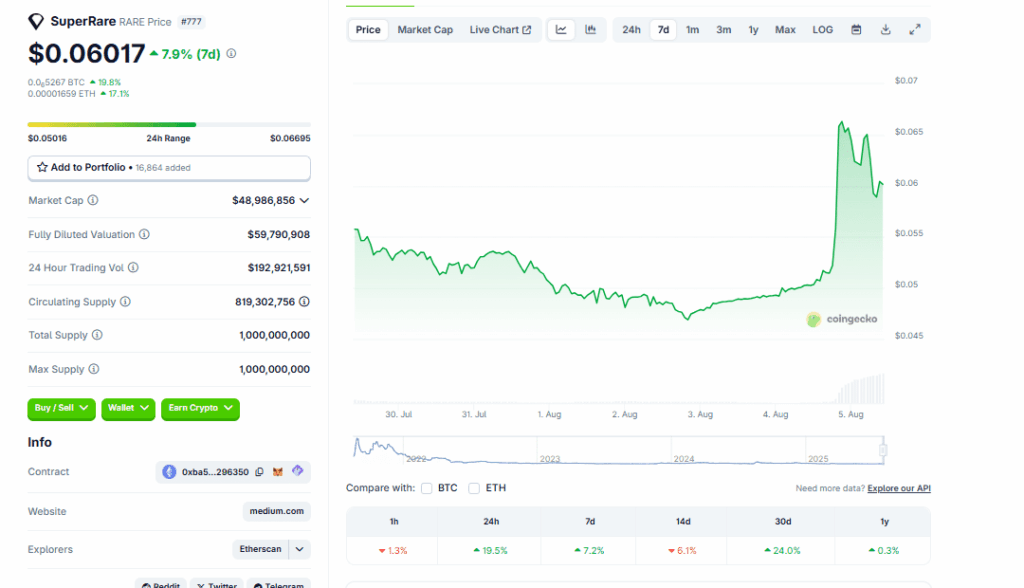

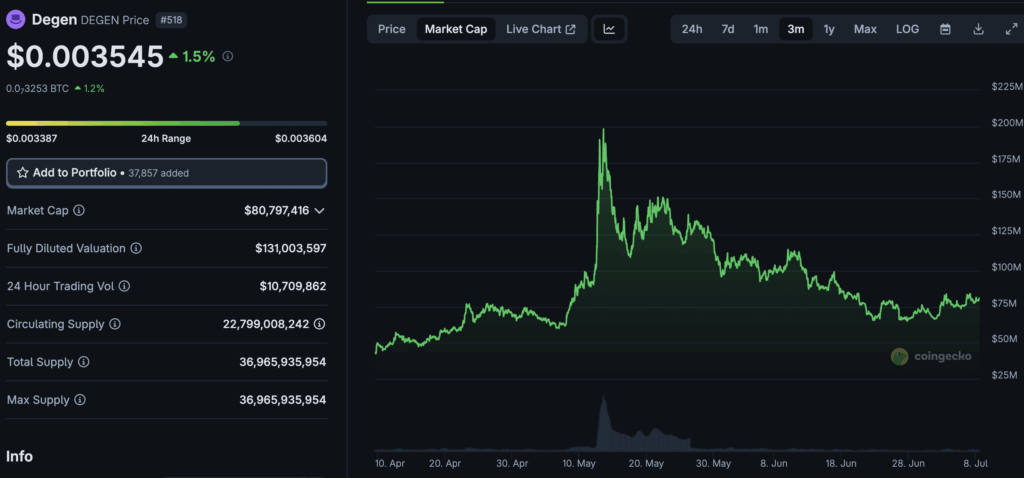

CoinGecko data shows daily fees on the blockchain have increased by more than 200% since May.

That signals amplified on-chain activity and soaring demand for decentralised liquidity.

Most importantly, the statistics signal DeFi borrowing resurgences.

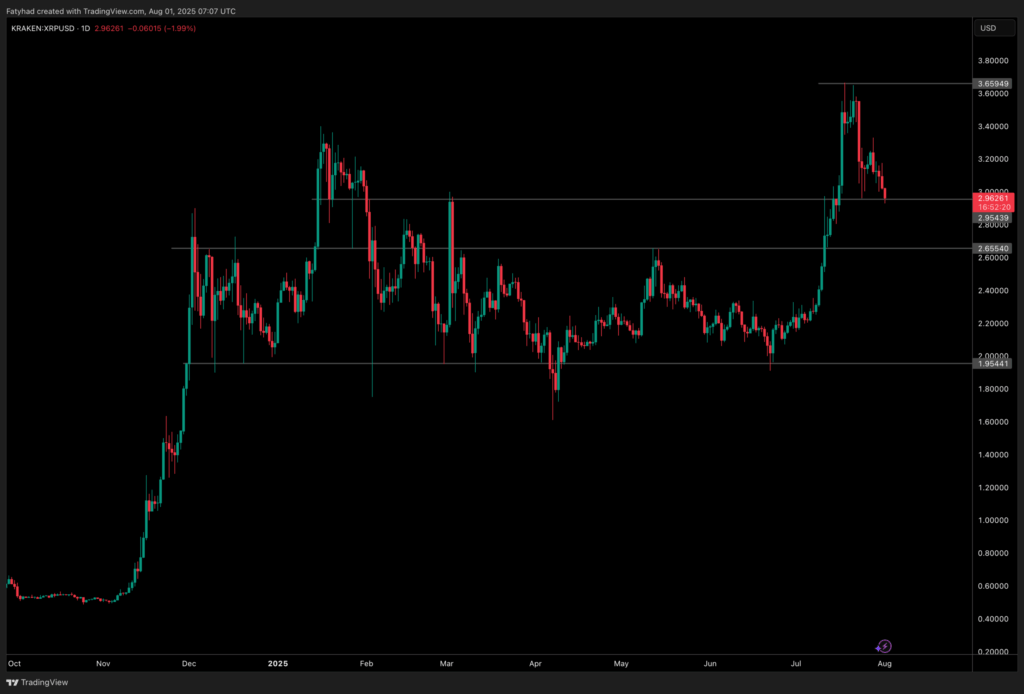

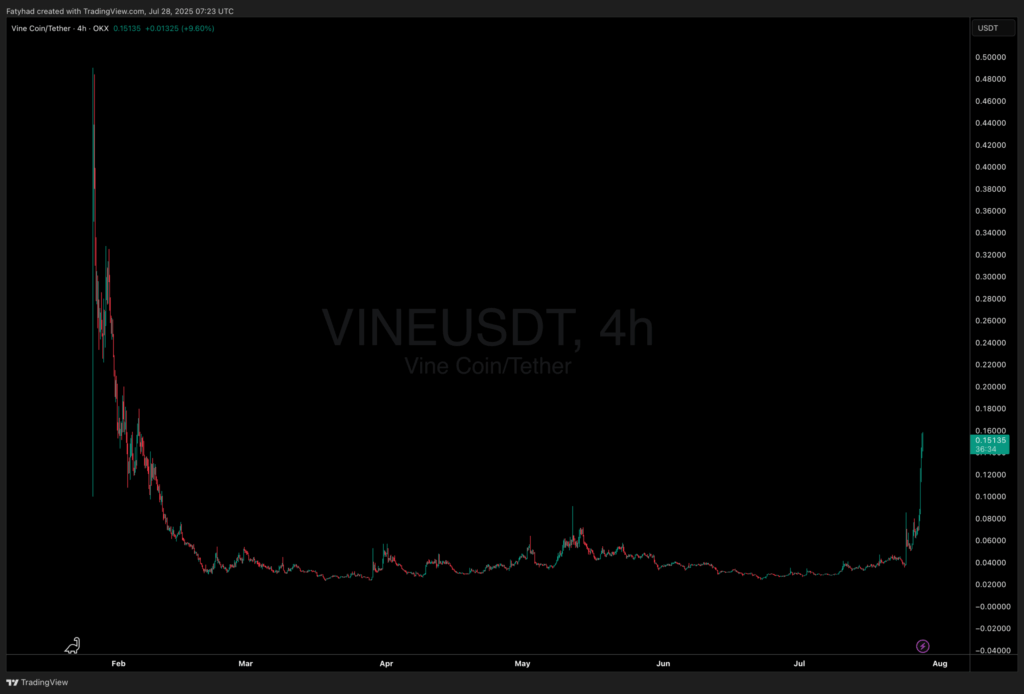

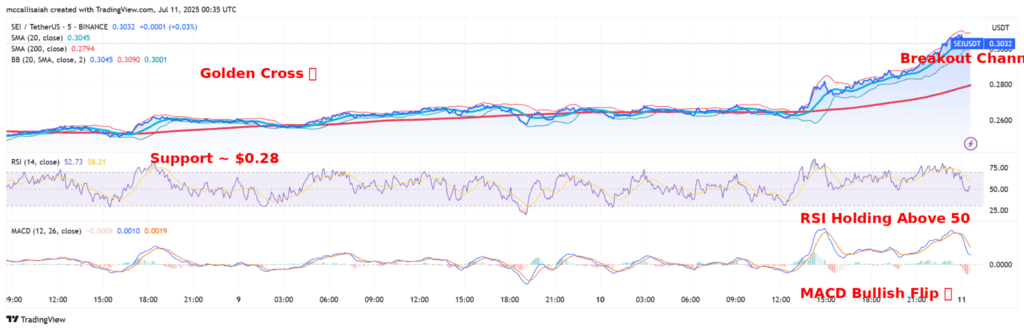

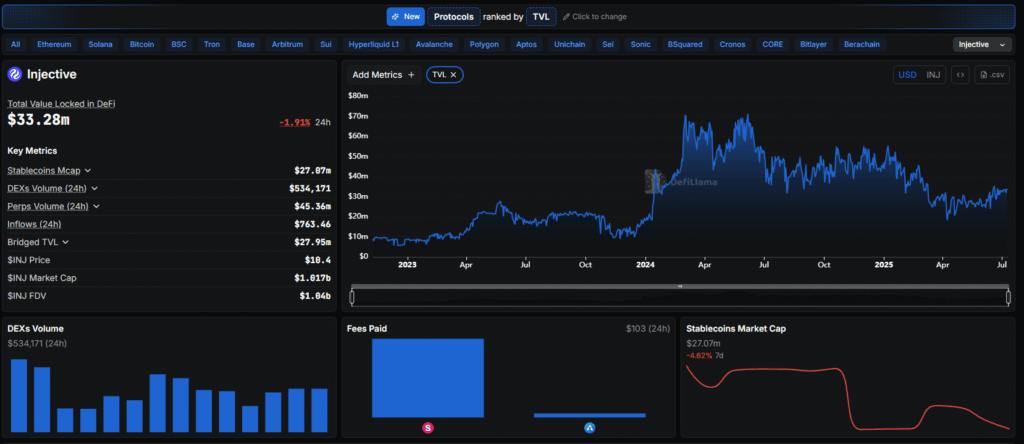

The chart shows AAVE’s 24-hour fees were below $1.2 million in early May.

It had surpassed 43 million as of the end of July, printing multi-month highs.

Revenue saw a modest gain (still below $500K) compared to collected fees, but the increase reflected enriched platform profitability.

Furthermore, the chart reflects significant dips and spikes in fee activity, which indicates healthy volatility.

Such fluctuations suggest an active lending market with healthy utilisation, and not instability.

Meanwhile, daily fees are the revenue engine for Aave.

The prevailing trend signals emerging resurgences for the protocol that saw flattened activity early in the year.

What’s driving Aave fees?

Borrowing demand is at the centre of the surging daily fees in the ecosystem.

Individuals pay interest whenever they borrow on Aave, and these payments account for the highest portion of the daily fees.

Fee income increases when more users take loans, possibly to chase price actions or leverage yield opportunities.

Also, the latest integrations have propelled fees.

For instance, users have deployed more than $60 million into yield-generating opportunities via MetaMask’s Aave-powered Stablecoin Earn feature.

In just one week, over $60M is generating yield through @MetaMask‘s new Stablecoin Earn product.

Powered by Aave. pic.twitter.com/mYcaQnkgyZ

— Aave (@aave) August 4, 2025

Such streamlined plug-ins make it smooth for retailers to access lending markets, enriching demand for AAVE’s liquidity pools.

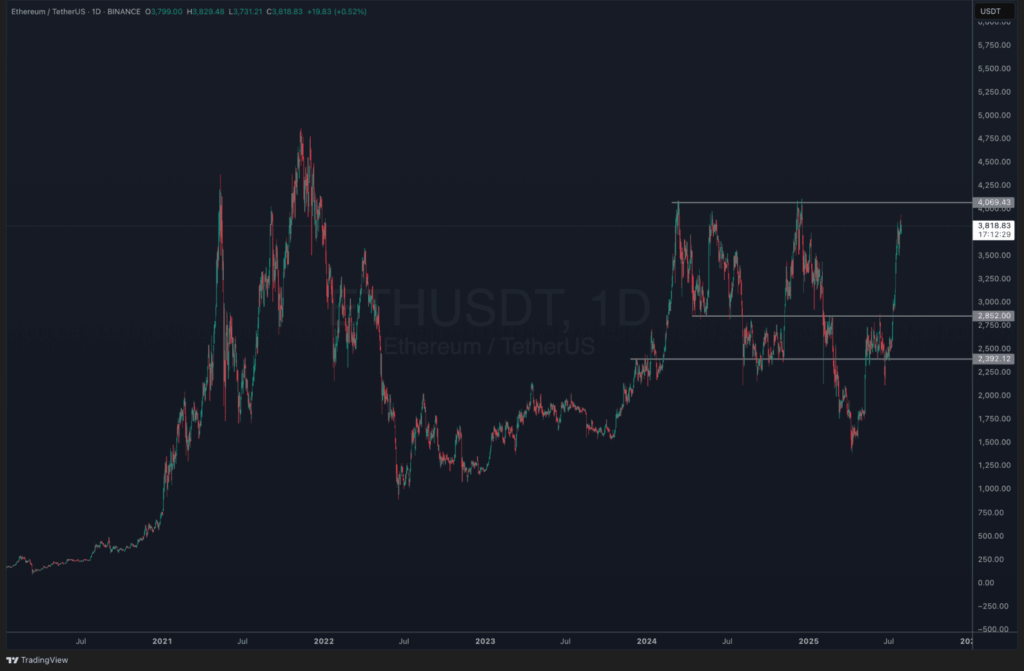

Moreover, the latest stable Ethereum price actions have encouraged users to (directly) interact with dApps again.

ETH has performed well over the past few sessions, even driving the “altcoin season” narrative.

Fees and protocol activity have surged as participants borrow assets, including stablecoins, from Aave.

AAVE price outlook

The native token reflected the increase in on-chain activity with notable gains.

It has gained approximately 60% since May 1 to press time levels of $263.

That makes it one of the top-performing DeFi assets this cycle – a notable feat, as meme coins, L2s, and centralized narratives dominate the trends.

Meanwhile, the rising fees will possibly boost revenue in the upcoming sessions.

That would bolster sentiments around Aave and its native coin.

Continued borrowing activities will likely help the protocol cement its status in the DeFi lending landscape, which would bolster AAVE’s utility and price gains.

Analyst CW predicts short-term recoveries for the altcoin.

He highlighted that AAVE’s nearest resistance zone is at $325, a nearly 25% increase from the market price.

The sell wall for $AAVE is at $325, near the previous high. pic.twitter.com/XIEdIiSrOk

— CW (@CW8900) August 5, 2025

Also, experts remain optimistic about AAVE’s performance.

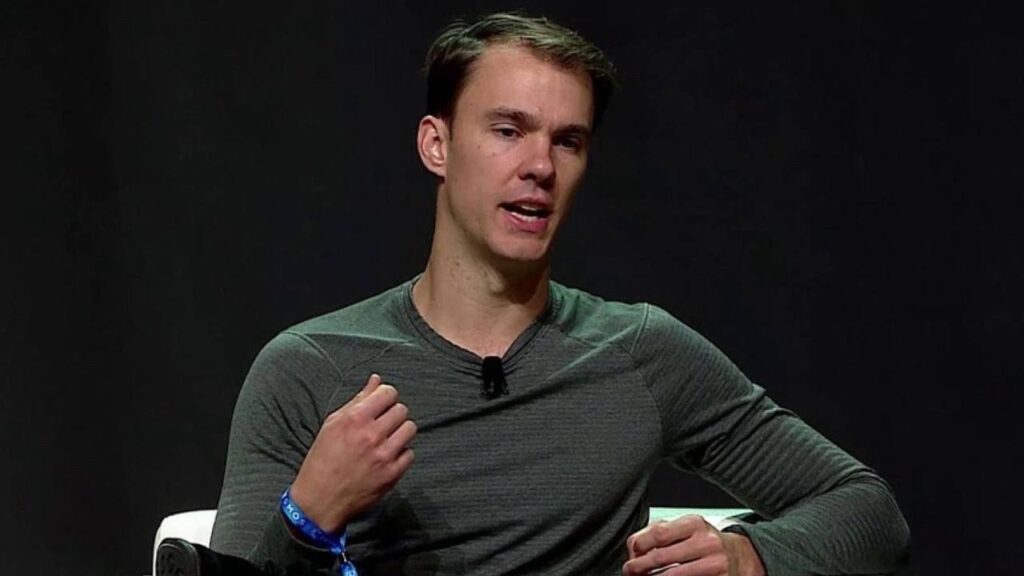

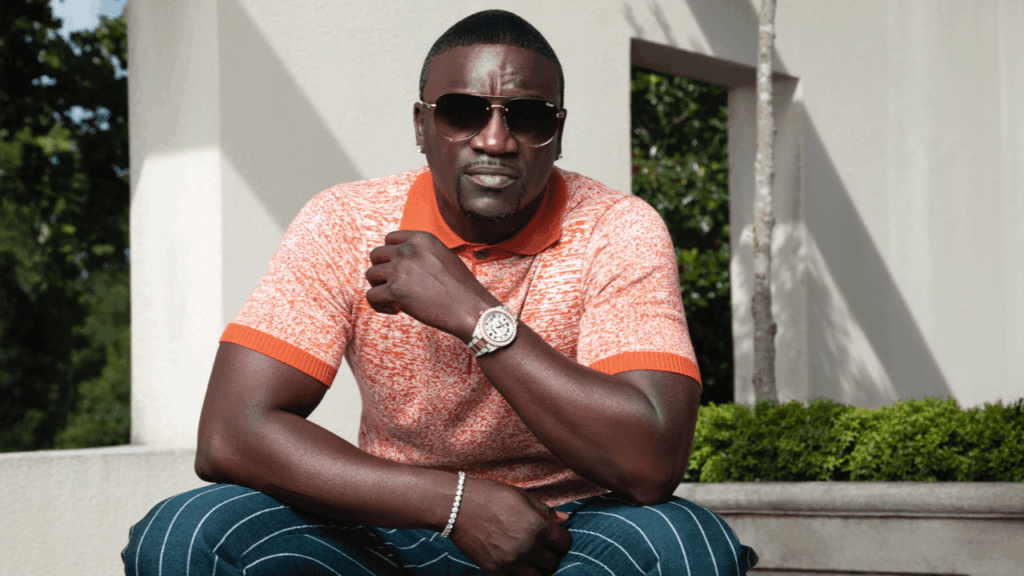

For example, the BitMEX co-founder recently purchased significant amounts of the token via over-the-counter.