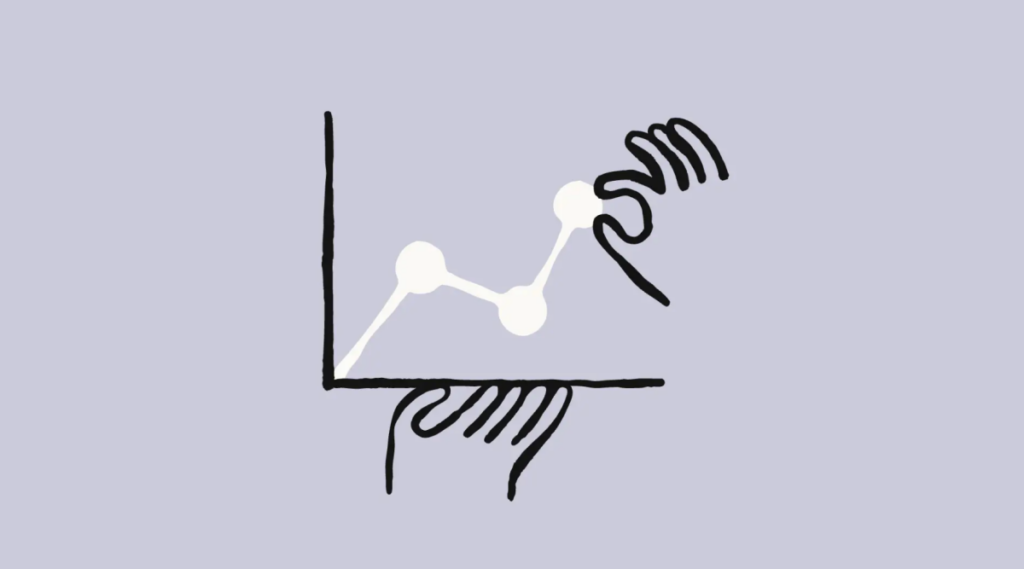

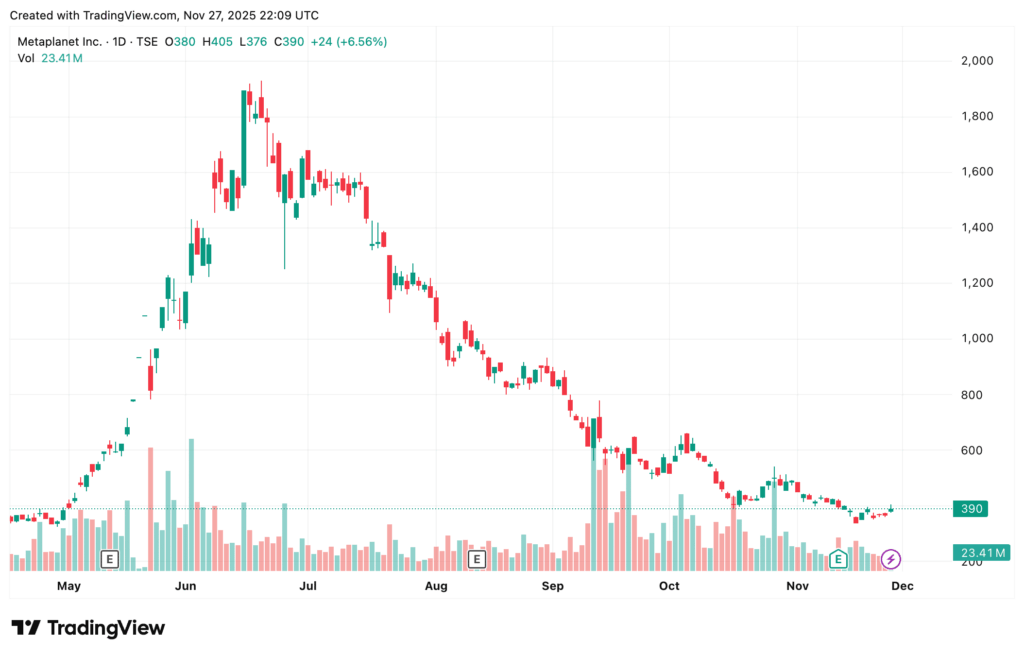

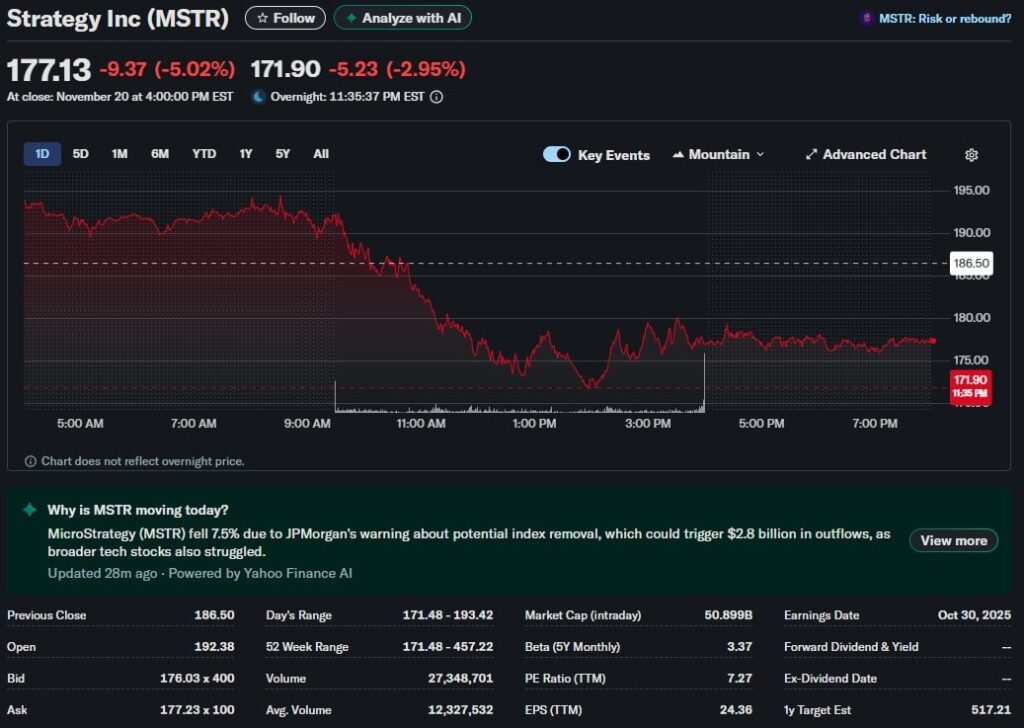

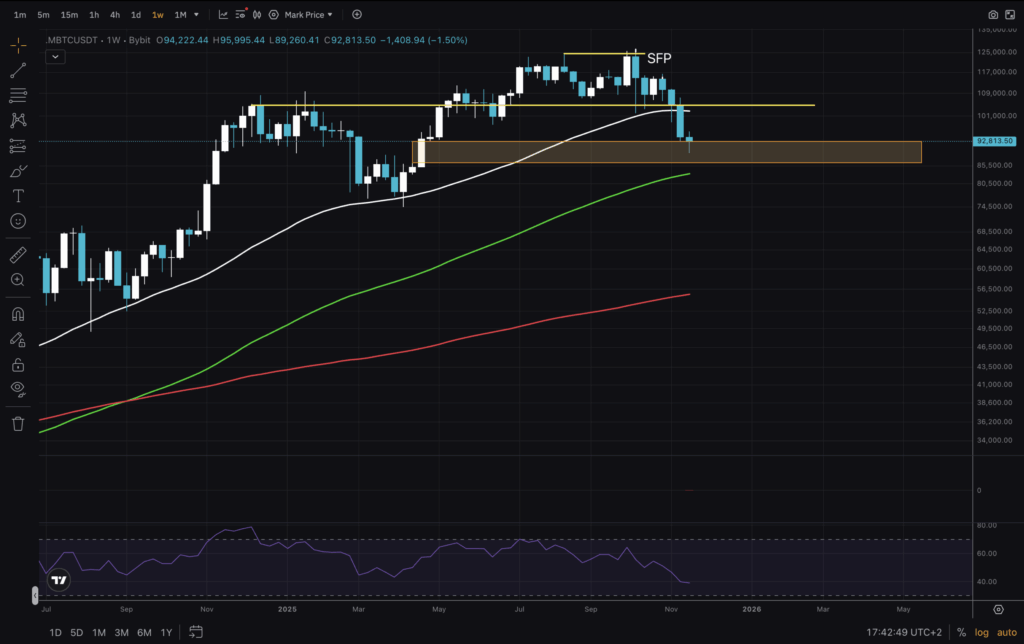

Bitcoin (BTC) Has Entered a Bearish Phase, Structural Indicators Confirm

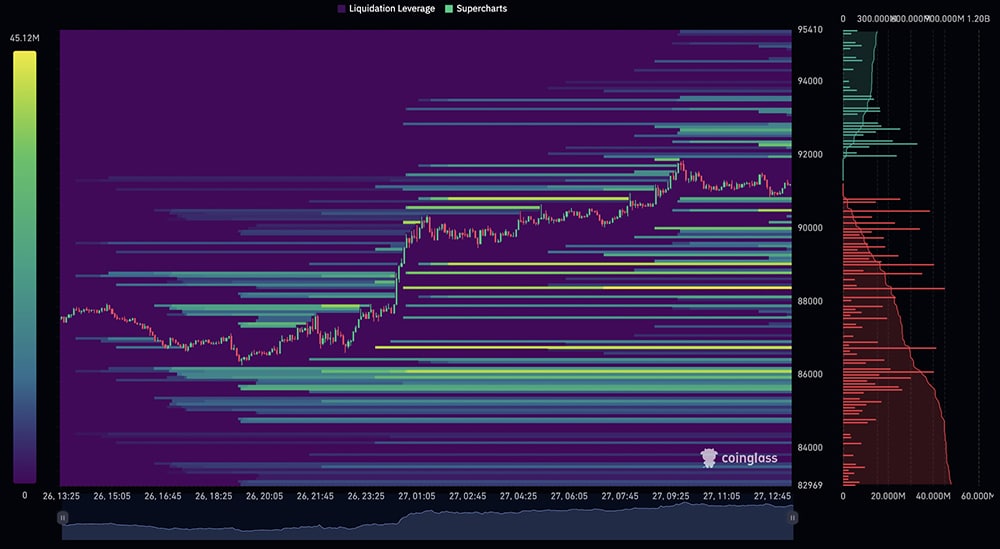

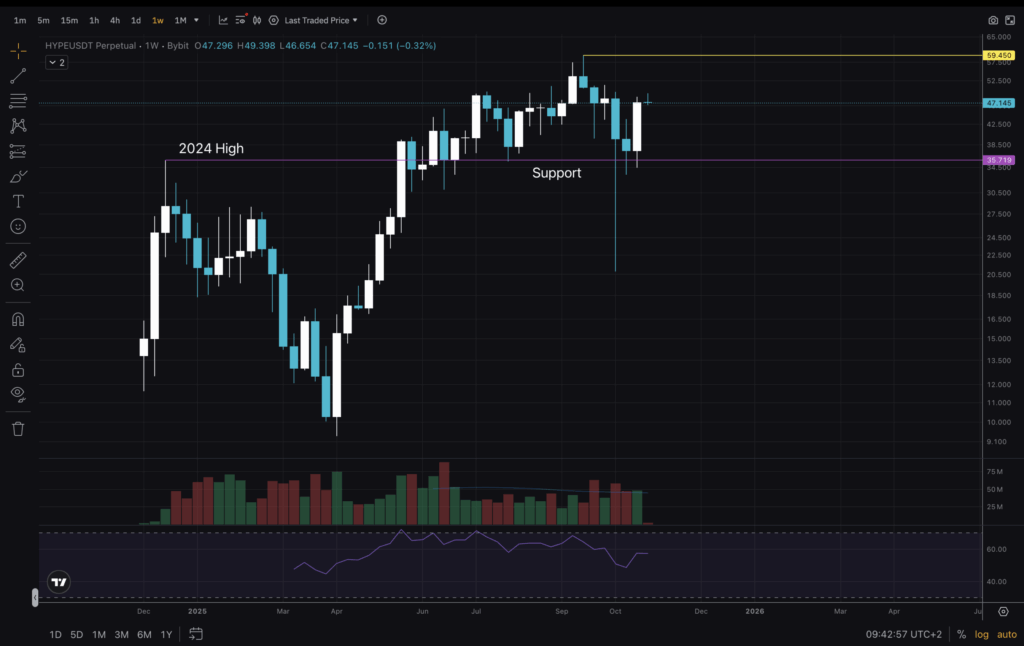

Bitcoin’s Structure Shift indicator has dropped to -0.5, and hence a firm transition begins.

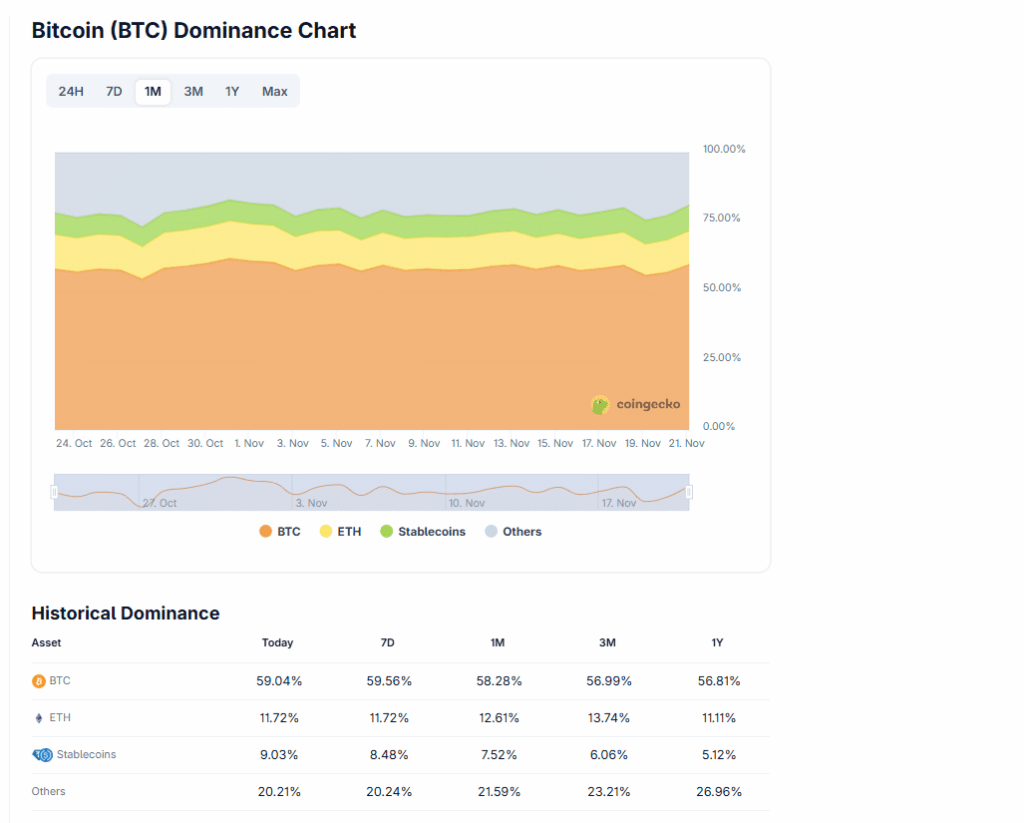

Bitcoin (BTC) is showing clear signs of entering an increased risk-off phase as market structure indicators shift into bearish territory.

According to analyst Axel Adler Jr., both the Structure Shift composite indicator and the Bull-Bear Index point to growing downward pressure, particularly in the derivatives market.

Risk-Off Signals Flash Red

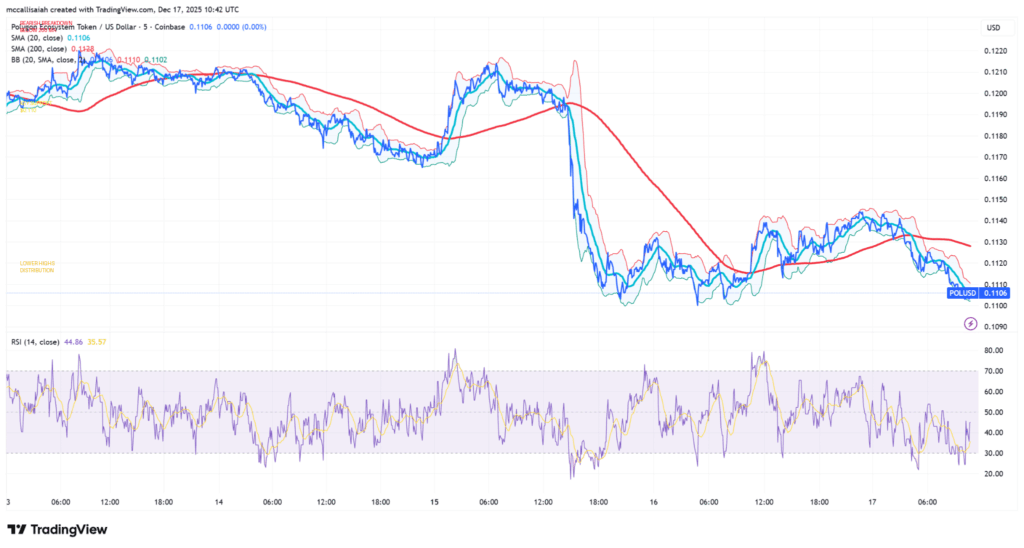

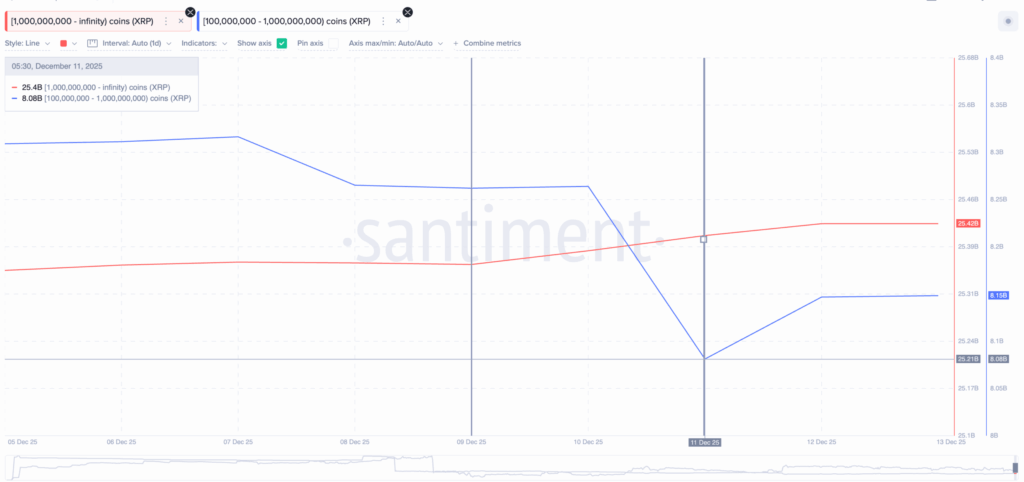

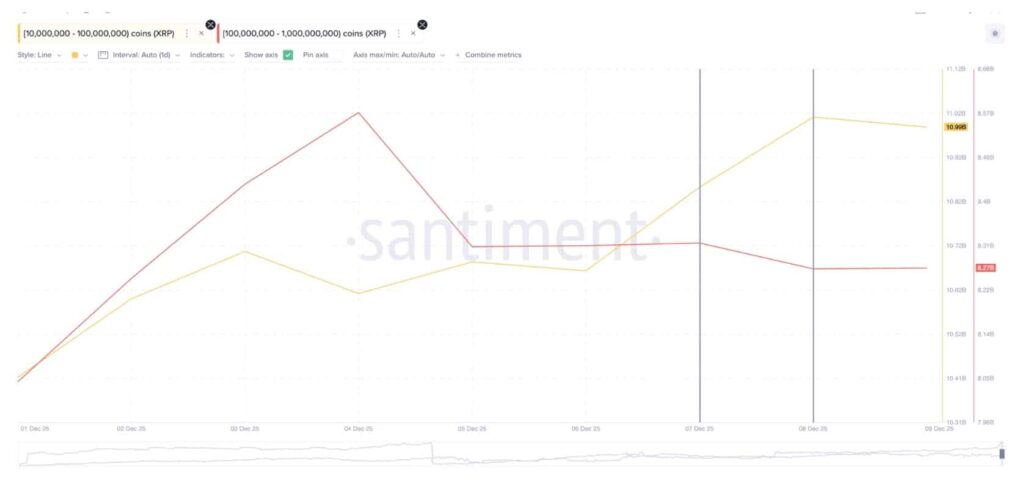

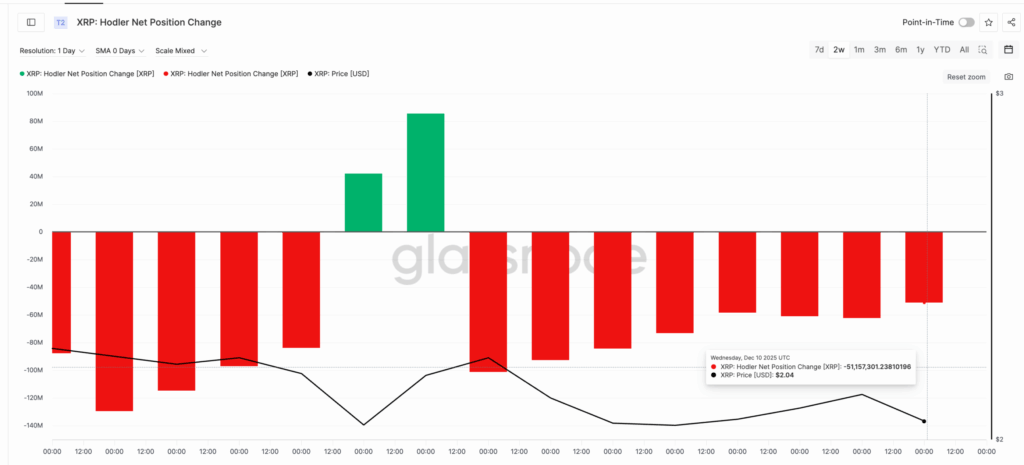

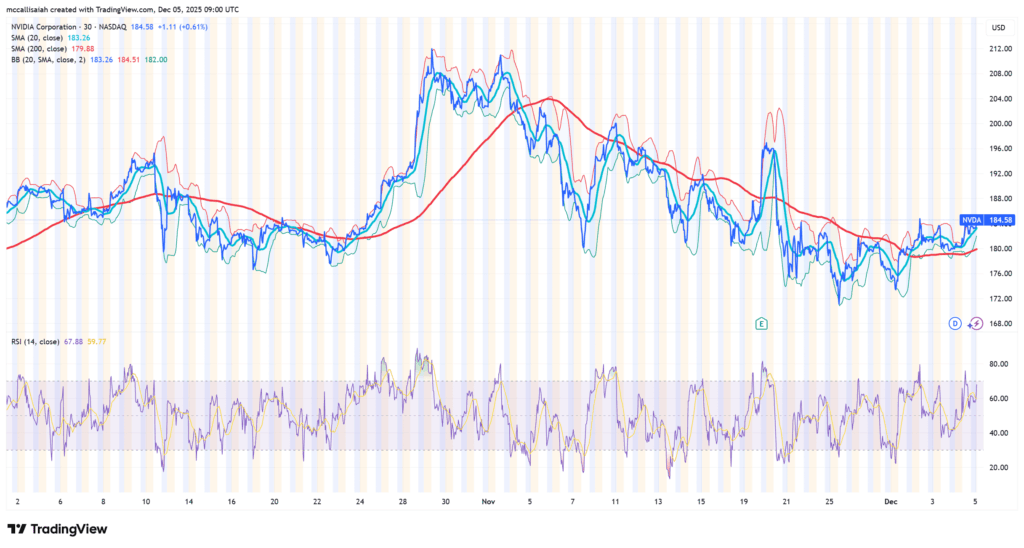

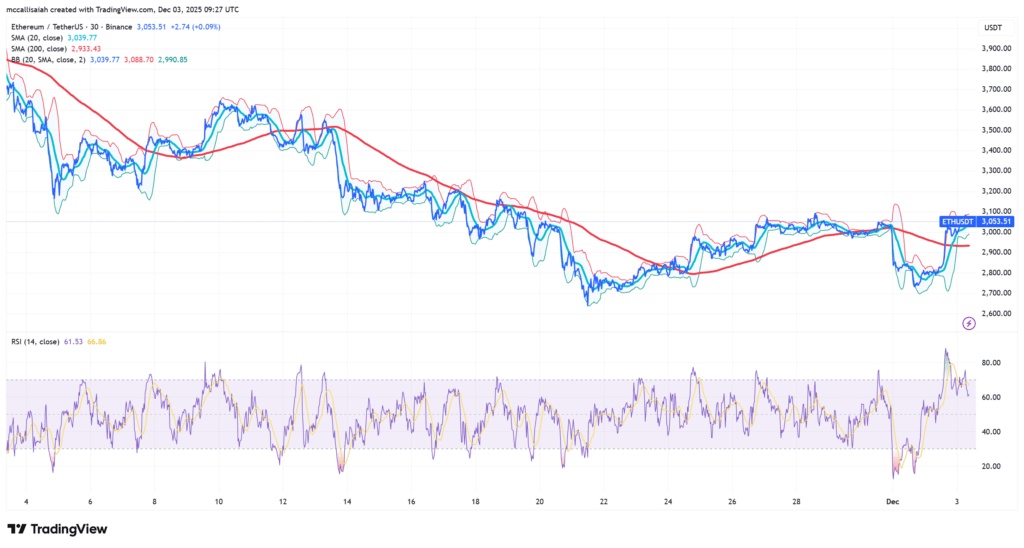

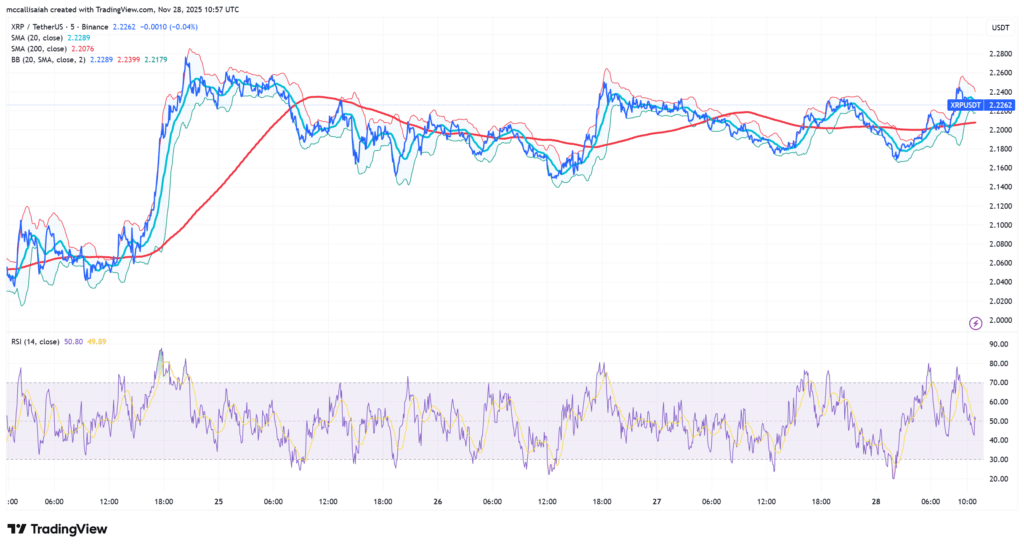

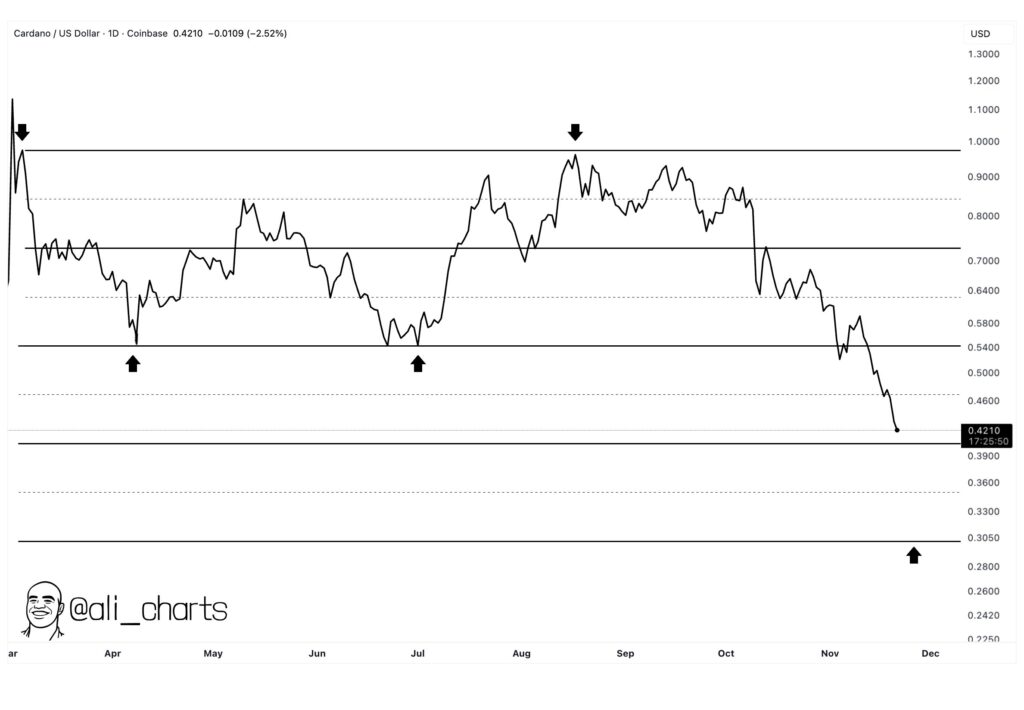

The Structure Shift signal, which measures overall market structure on a scale from -1 to +1, has fallen from positive territory to around -0.5. This confirms the dominance of a bearish regime.

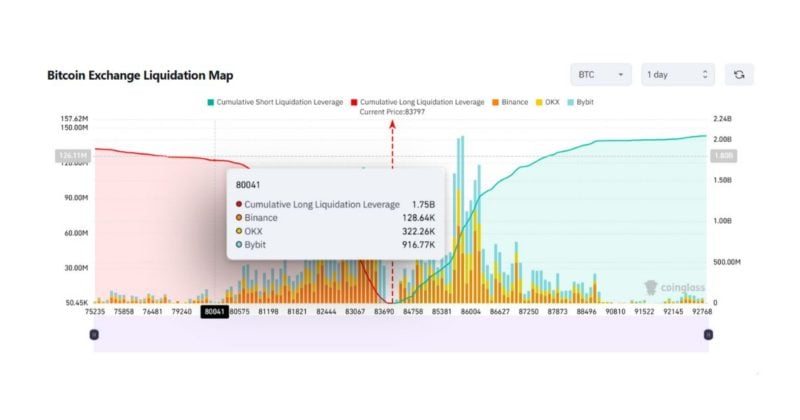

At the same time, Bitcoin’s price has dropped toward the lower boundary of the 21-day Donchian Channel, currently hovering near the $85,000 support level. This means that the market has not only firmly established itself in a bearish structural zone, but any recovery will require the composite signal to move back above zero while holding channel support.

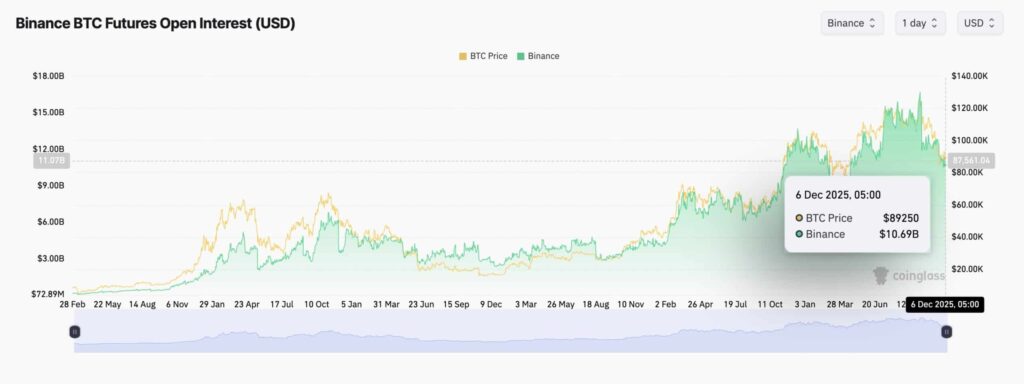

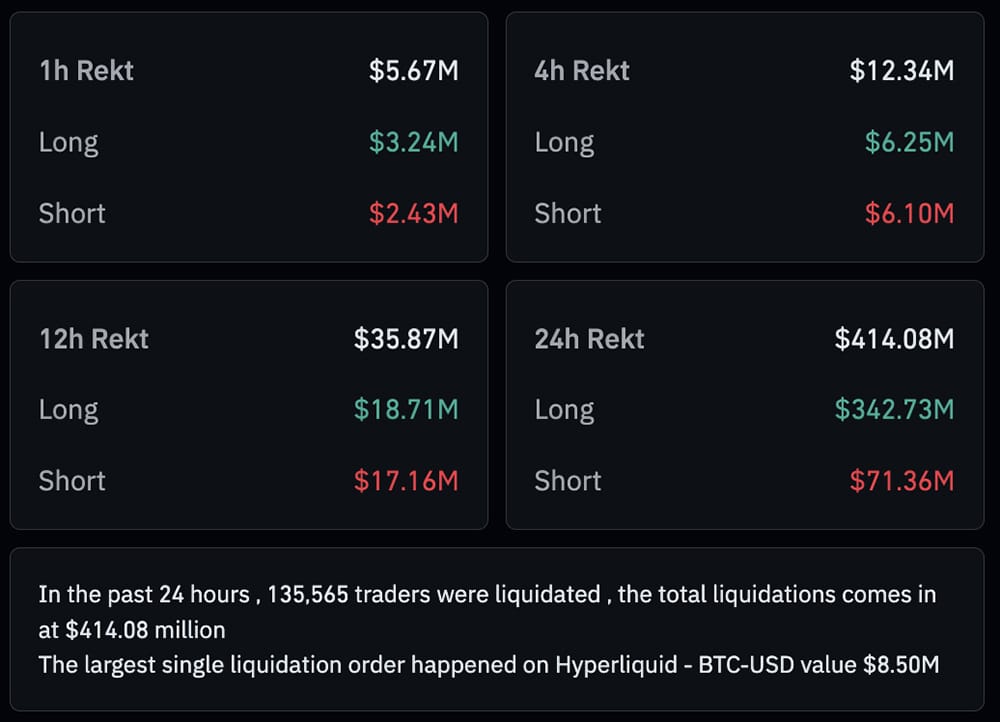

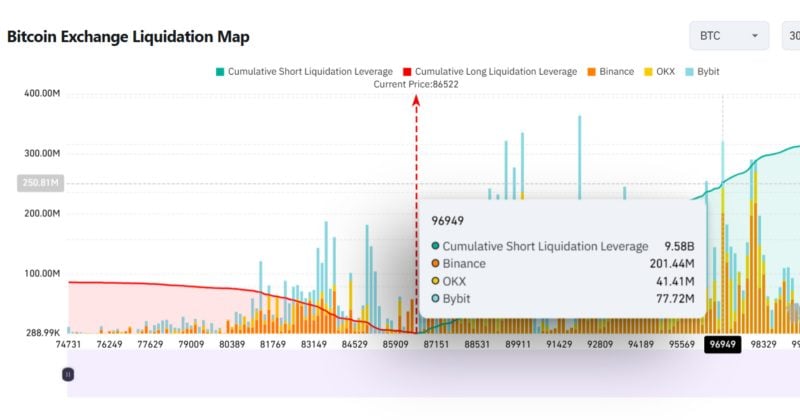

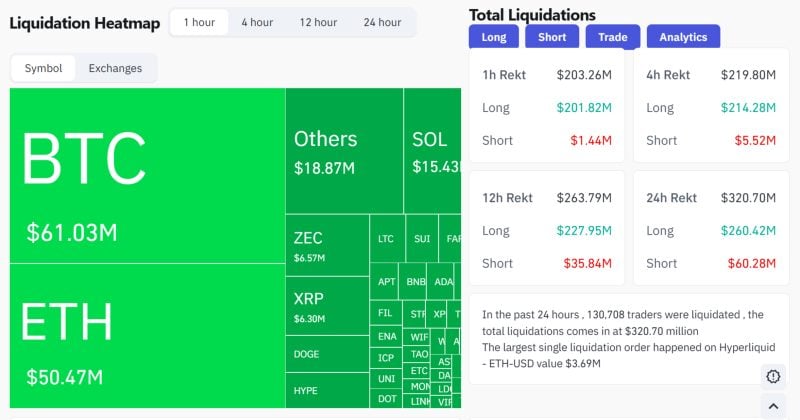

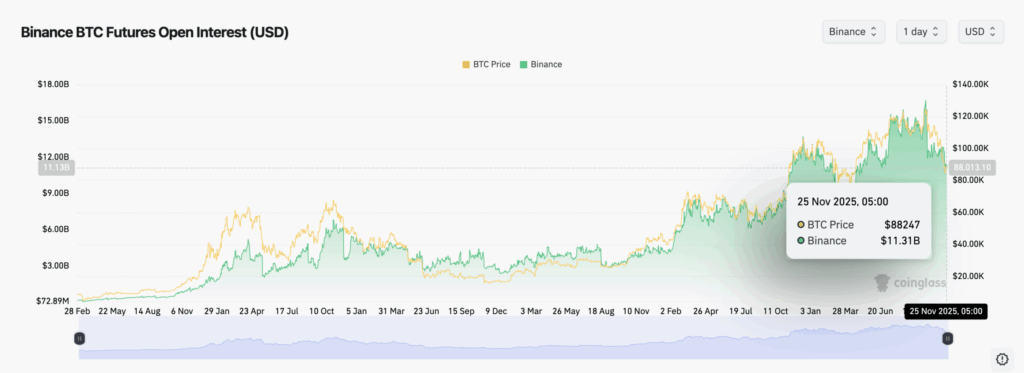

Derivatives are playing a key role in this transition. The Bull-Bear Index, which separates short-term and long-term market pressure, shows the fast bearish component moving into negative territory, while the bullish component has dropped to just 5%. Such a pattern suggests that selling pressure from futures markets is outweighing demand in the spot market, thereby leaving short-term momentum firmly in the bears’ favor.

Adler explained that while a negative Structure Shift signal does not predict an immediate price drop, it does show the need for defensive positioning.

Whales and Miners Defy Bitcoin Sell-Off

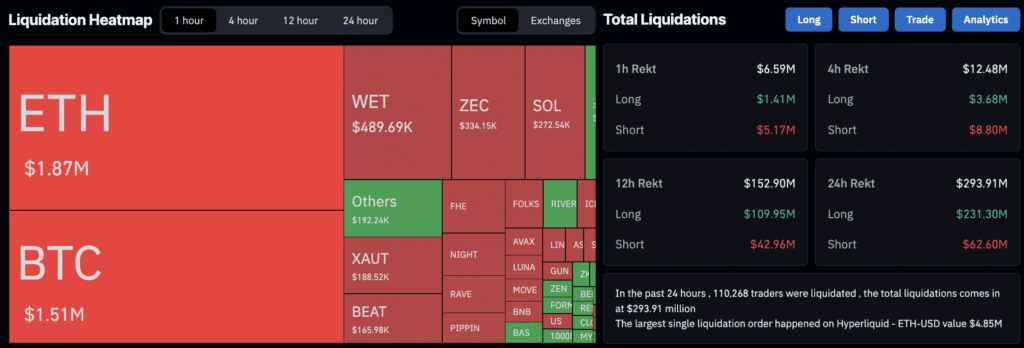

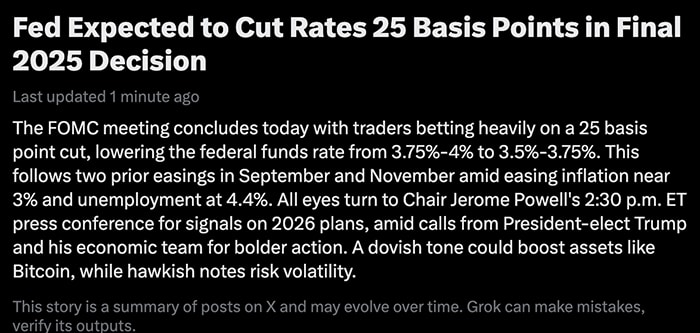

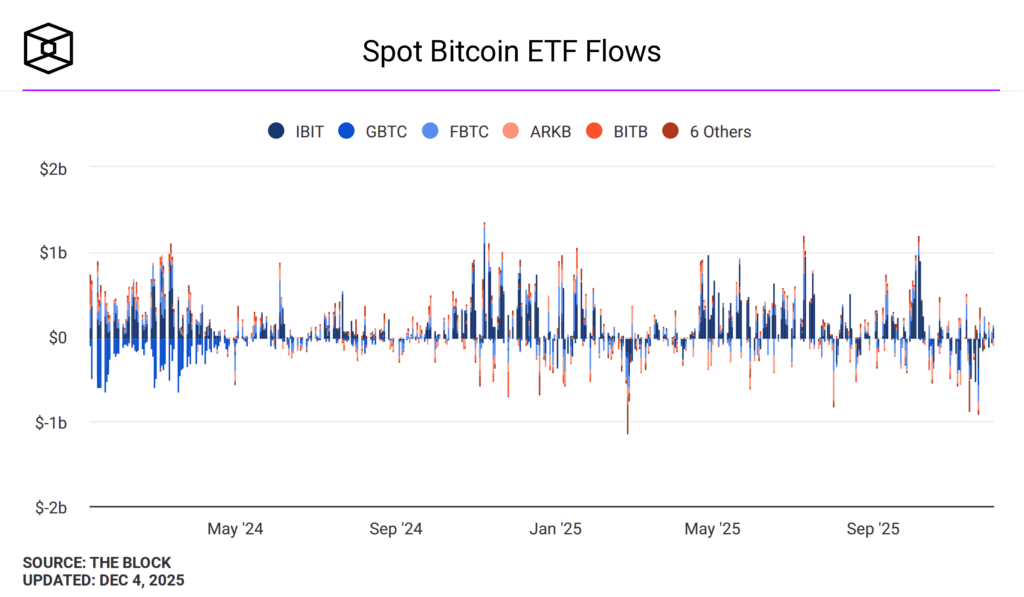

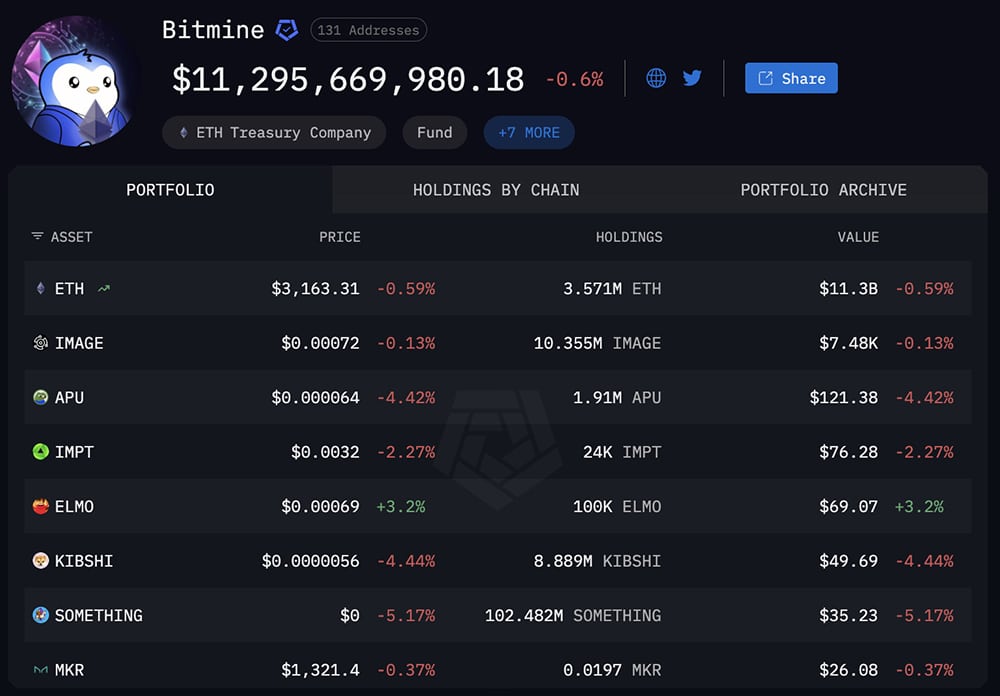

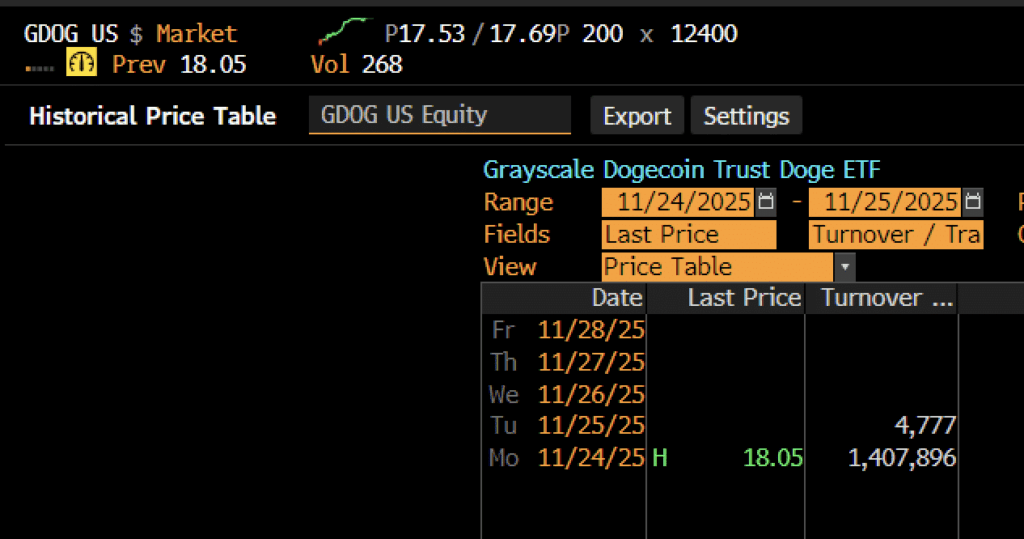

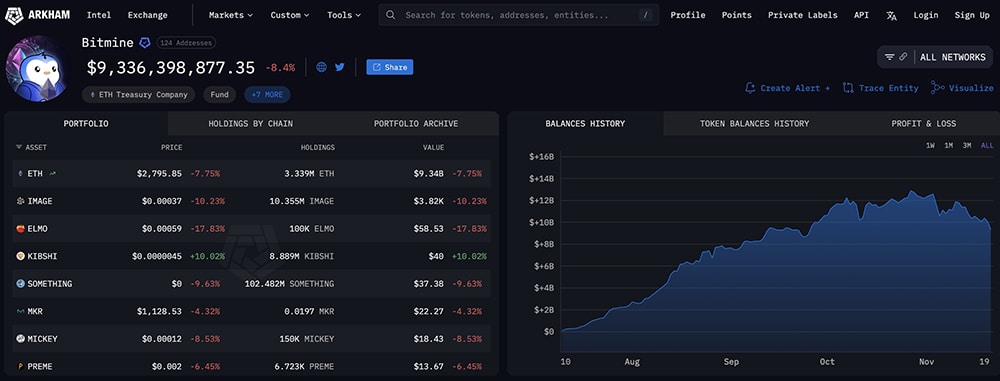

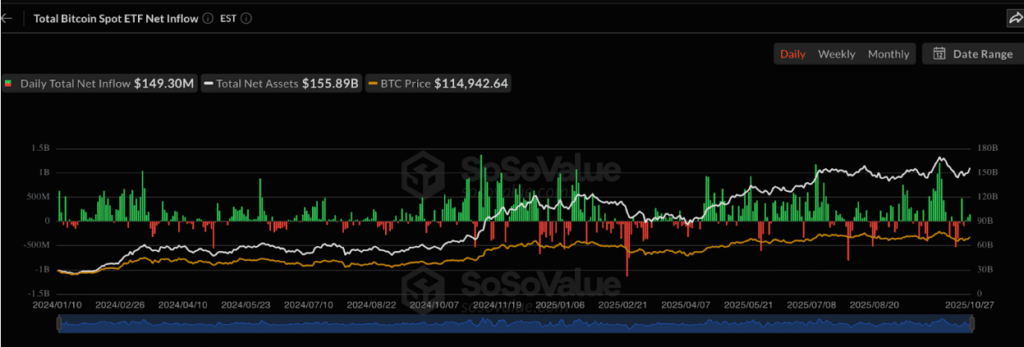

CryptoQuant data added further context to the current regime. While US spot Bitcoin ETFs recorded combined outflows of roughly $635 million over two days, on-chain indicators point to significant pessimism among short-term participants.

You may also like:

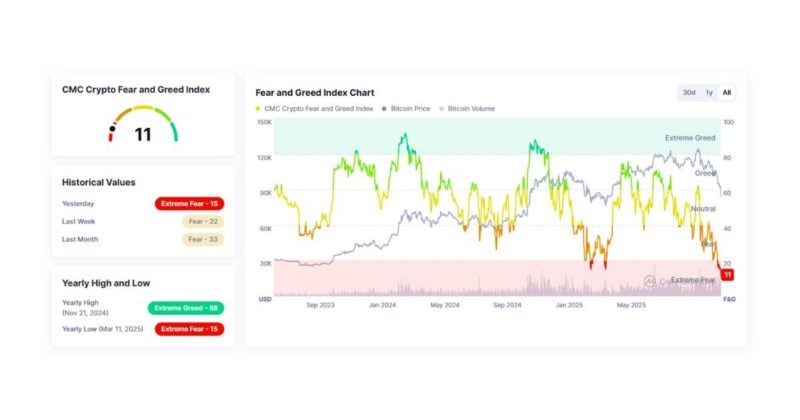

The Coinbase Premium Gap has dropped to deeply negative levels, while the Fear and Greed Index shows extreme fear as it sits at 11. Additional stress indicators, including rising supply in loss, and a depressed short-term holder MVRV, indicate many recent buyers are capitulating at a loss.

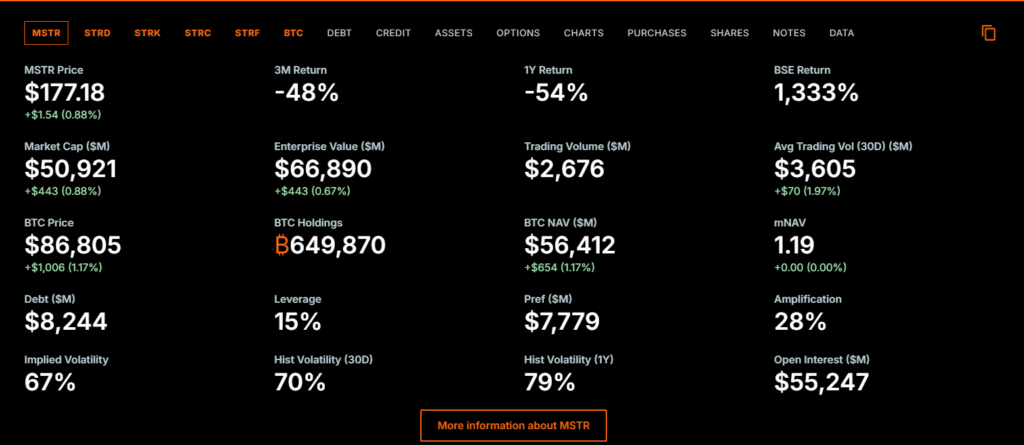

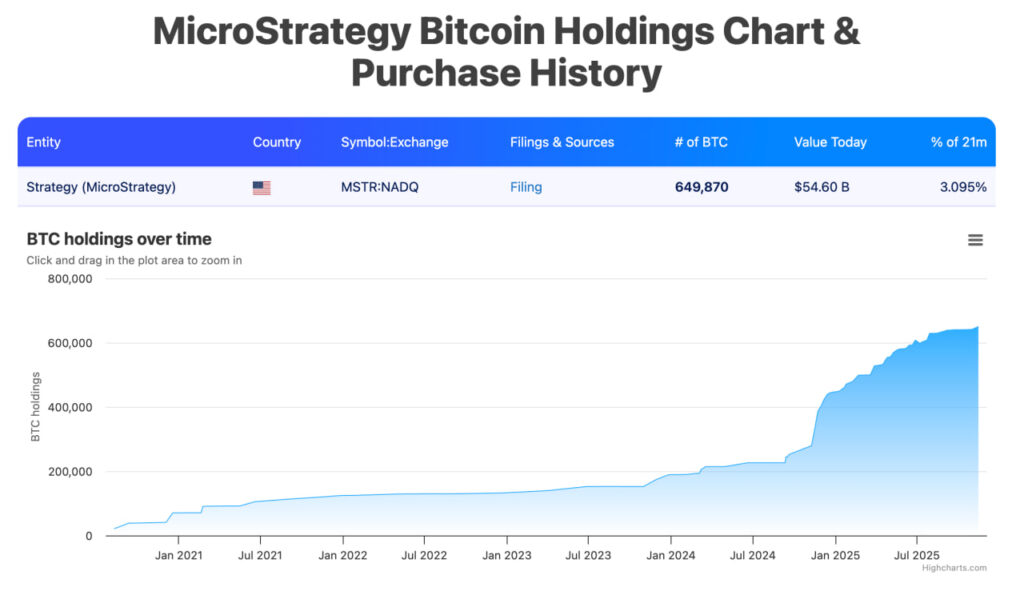

However, a certain cohort of whales and miners continues to act as outliers in this environment. For instance, the Miner Position Index (MPI) at -0.81 indicates miners are sending fewer BTC to exchanges and thus reducing selling pressure. Meanwhile, wallets holding between 1,000 and 10,000 BTC have accumulated nearly 700,000 BTC over the past two months.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.