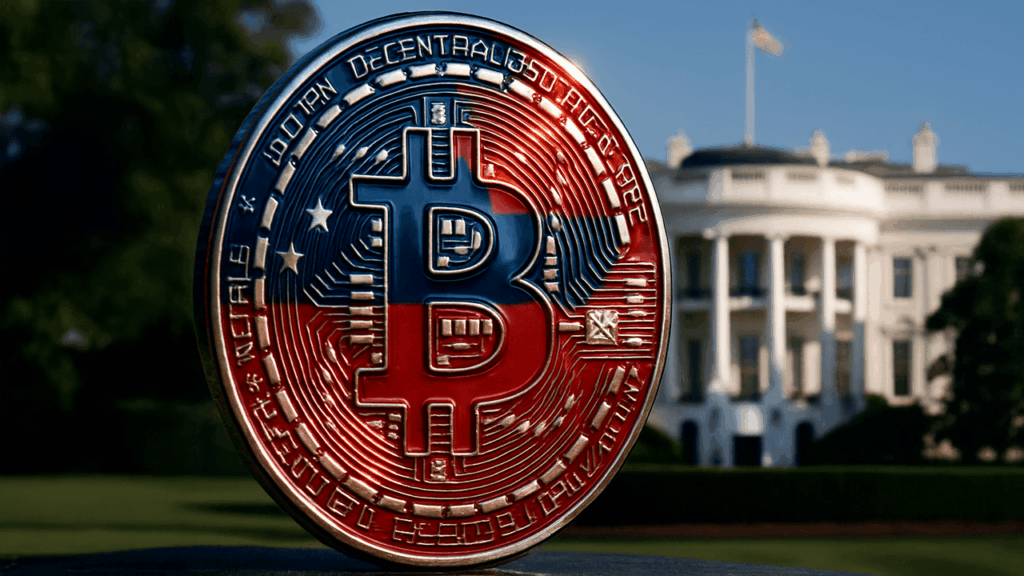

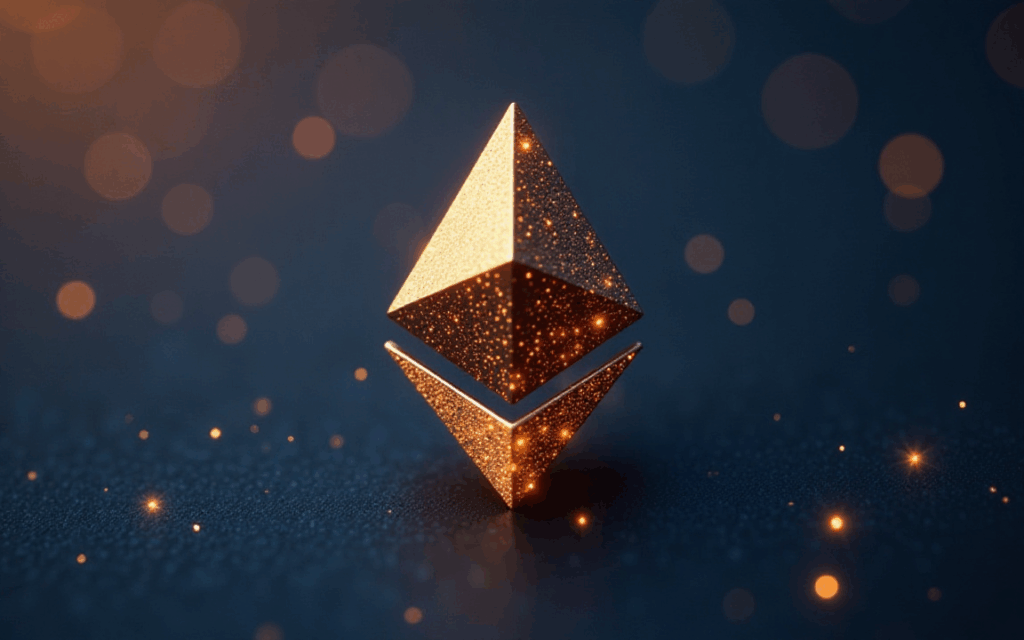

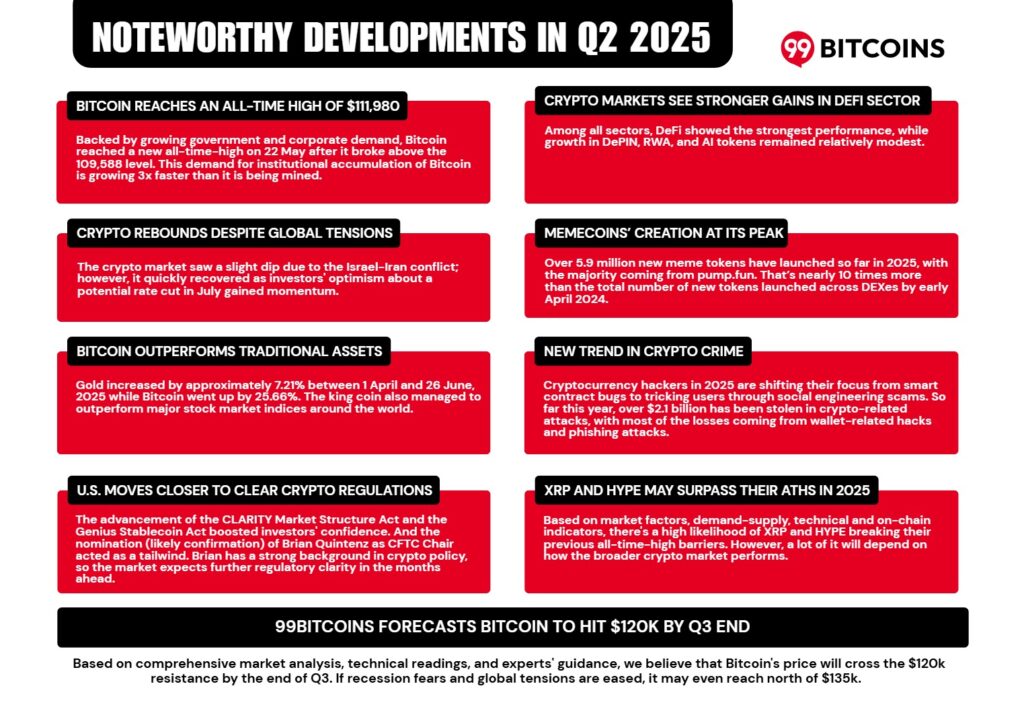

White House Lays Out Detailed Crypto Policy Blueprint

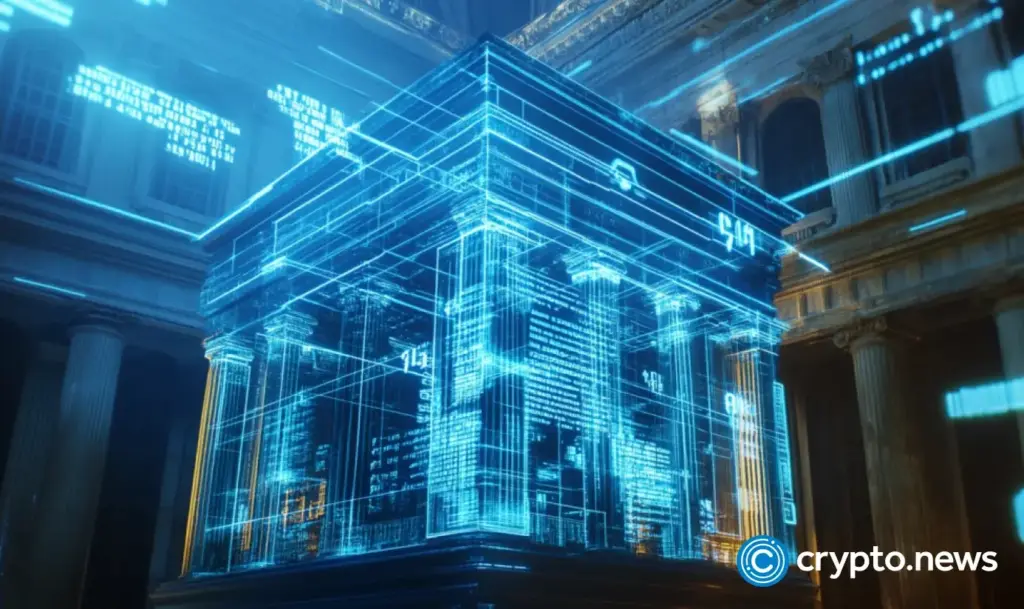

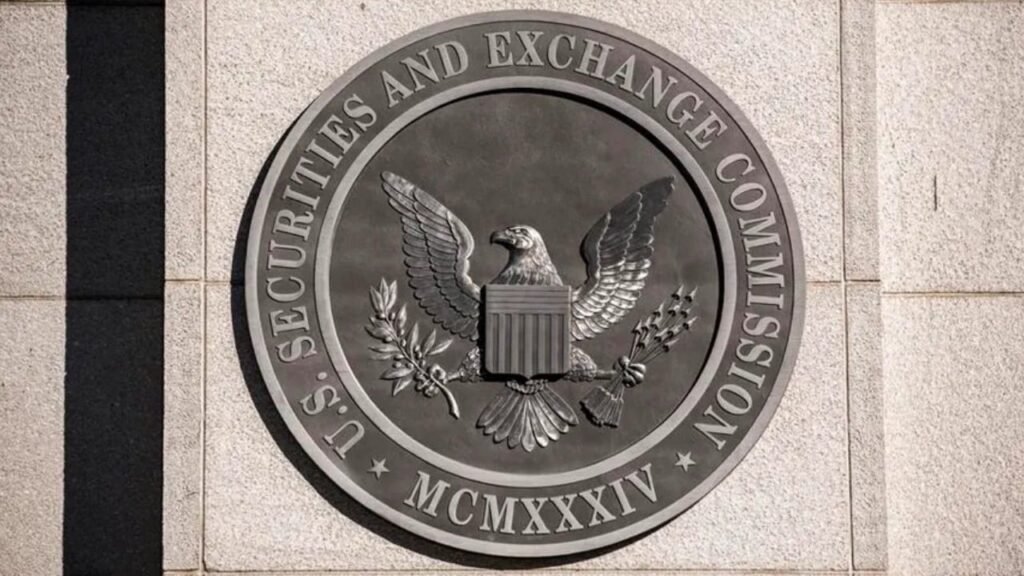

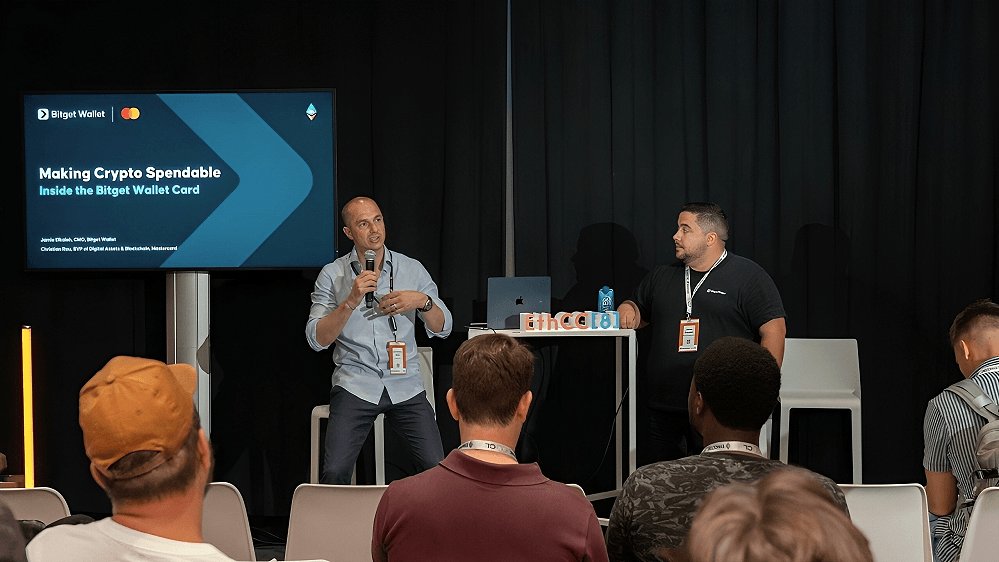

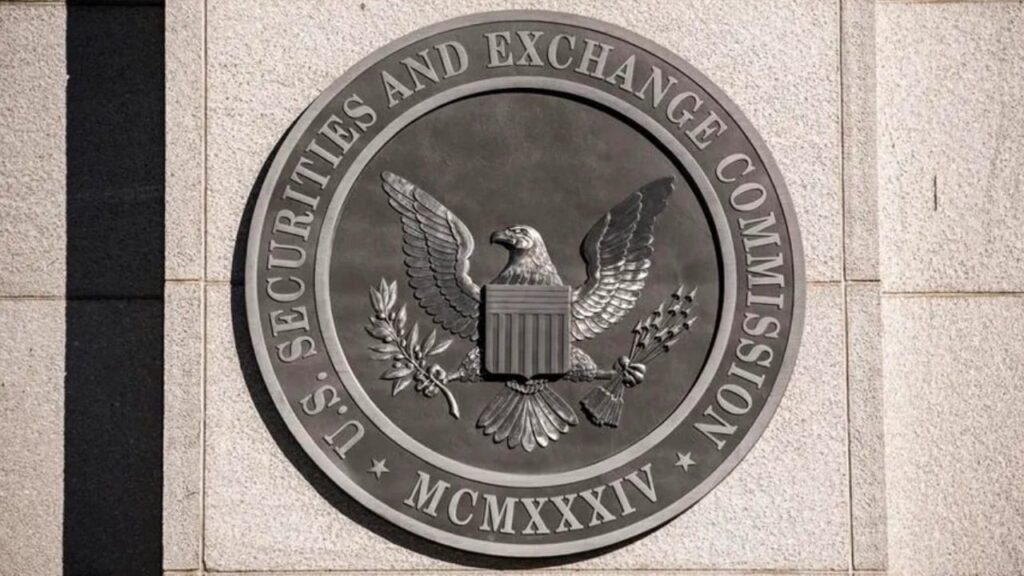

The White House has released a 160-page roadmap outlining how it plans to approach crypto regulation going forward. It brings together insights from major agencies like the Treasury, SEC, and CFTC. Officials are calling it the most comprehensive federal policy guide ever created for digital assets, aimed at setting clear rules while still leaving room for innovation.

Coordinated Action Replaces Scattered Responses

This new roadmap builds on a 2022 executive order but takes things further. Instead of scattered agency responses, it pushes for coordination on key areas like staking, token classification, stablecoin oversight, and DeFi monitoring. The goal is to stop treating crypto like an afterthought and start addressing it with consistent rules.

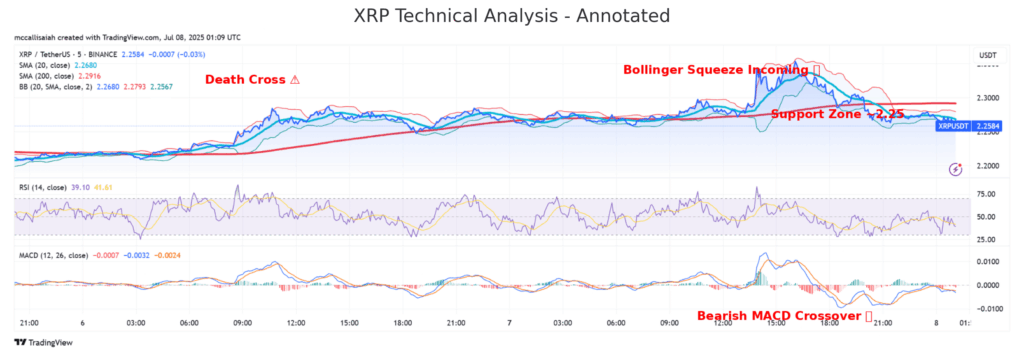

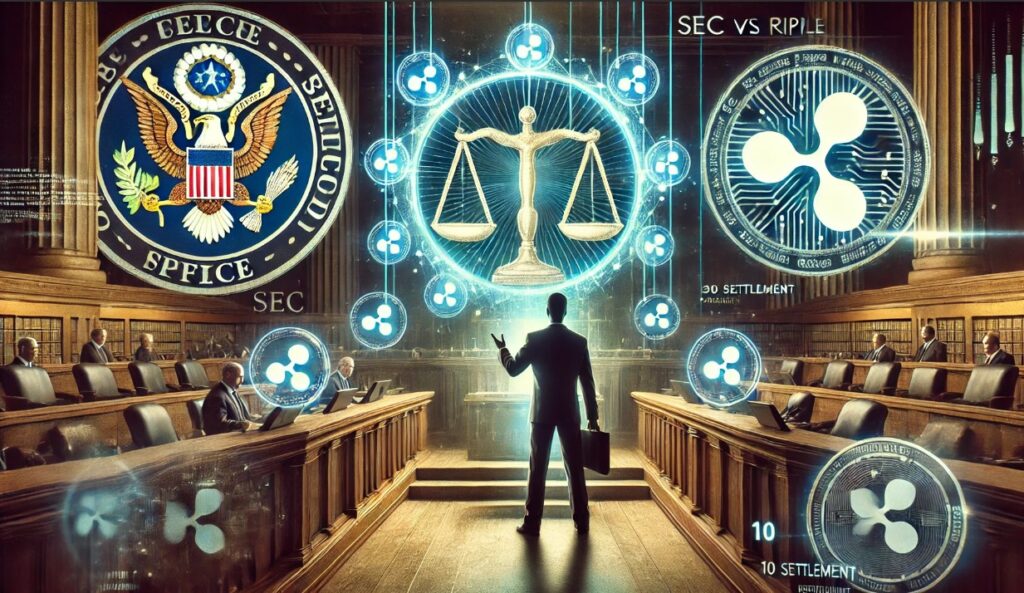

US WHITE HOUSE CRYPTO REPORT HAS BEEN RELEASED.

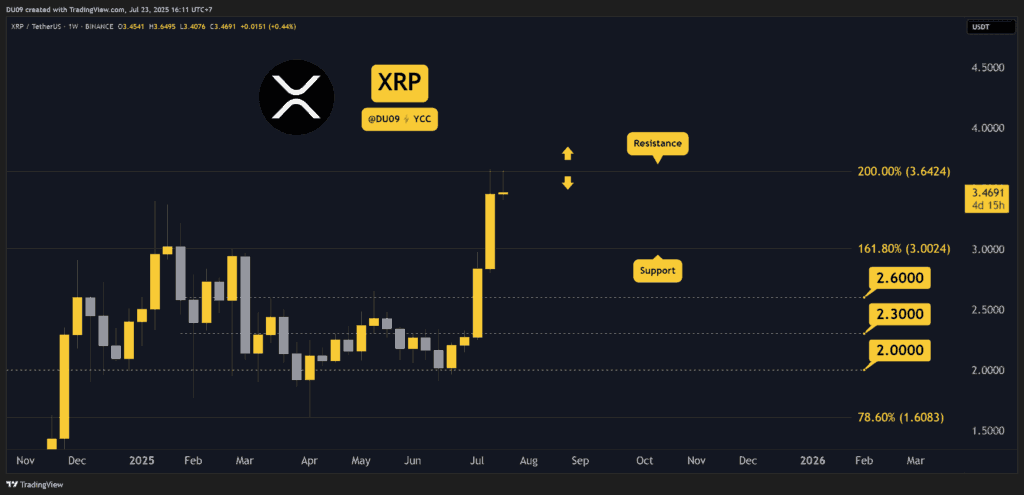

CROSS BORDER PAYMENT = XRP

US does NOT need Bitcoin, they need XRP. pic.twitter.com/UuruC77qTL

— {x} (@unknowDLT) July 30, 2025

Defining What Crypto Is and How It’s Treated

One of the roadmap’s big goals is to bring more clarity to how regulators define crypto assets. It pushes agencies to lay out when tokens are considered securities or commodities, how platforms should register, and what custody providers need to do to stay compliant. The roadmap also puts crypto tax reform on the table, especially for staking and mining activities.

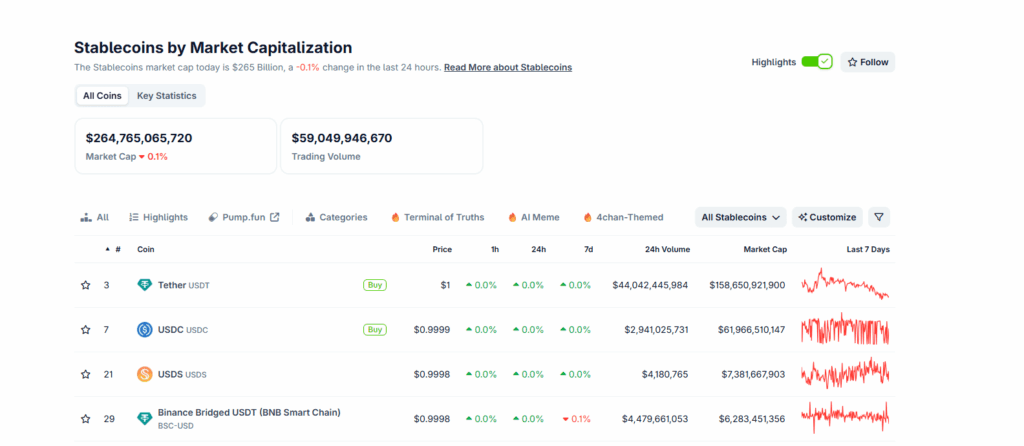

Stablecoins are getting special attention under the GENIUS Act, which pushes for a standardized framework across the country. Meanwhile, the administration is holding off on endorsing a U.S. central bank digital currency, saying current regulators have enough authority to handle things for now. Congress is being asked to step in and pass legislation that would lock some of these ideas into law.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Consumer Protection Is a Clear Priority

The collapses of major crypto firms over the past two years have clearly influenced this roadmap. Agencies are being told to step up enforcement and go after scams, shady custody practices, and pump-and-dump schemes. The plan also includes education efforts aimed at helping the general public understand the risks of crypto, especially those who aren’t already deep in the space.

Market Stability and Money Laundering Top the List

The report doesn’t gloss over concerns about systemic risk. Stablecoins and DeFi tools that could affect traditional markets are being flagged for tighter oversight. There’s a strong focus on improving how agencies share information and on beefing up anti-money laundering rules. The Justice Department is expected to lead some of the more aggressive enforcement efforts, particularly around things like ransomware and sanctions evasion.

Support for Innovation, but With Guardrails

Unlike previous approaches that leaned toward restriction, this roadmap leaves space for crypto companies to grow. The administration wants the private sector to continue exploring blockchain use cases, especially those that improve financial infrastructure. While a central bank digital currency is still under review, the overall message is that crypto doesn’t need to be stifled to be safe.

DISCOVER: 20+ Next Crypto to Explode in 2025

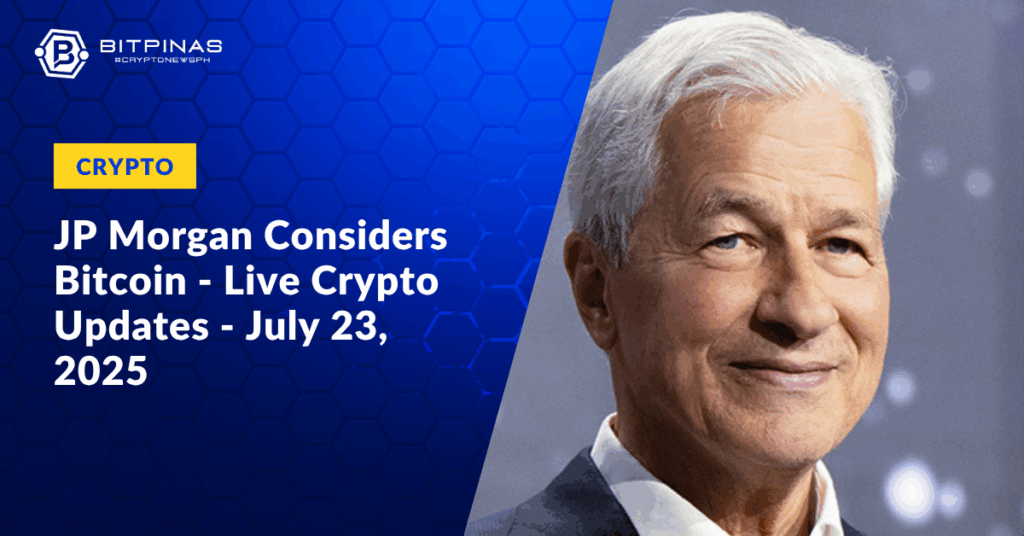

No Updates on the Federal Crypto Reserve Plan

Earlier this year, the White House floated the idea of creating a strategic reserve of Bitcoin and other digital assets. That plan is noticeably absent from this roadmap. There’s no mention of how it would be funded, managed, or integrated into the broader financial system. That leaves a big open question about the government’s long-term ambitions in this space.

Congress Still Holds the Keys

While regulators can move on some of these proposals immediately, others need Congress to act. That includes the most important pieces like stablecoin laws, asset classification, and possible reforms to exchange registration. A few bills are already in motion, but there’s no clear timeline for when anything might pass.

A Pivotal Moment for U.S. Crypto Policy

This roadmap is a turning point for crypto regulation. It takes crypto seriously and tries to build a framework where the industry can operate within clear legal boundaries. Whether this actually leads to better rules or just more red tape will depend on how quickly agencies and lawmakers move. Either way, crypto is no longer being treated like a niche issue in Washington.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The White House released a 160-page crypto roadmap with input from the Treasury, SEC, and CFTC, marking the most detailed federal policy effort on digital assets to date.

- The plan pushes for coordinated regulation across agencies, aiming to clarify token classifications, stablecoin rules, and DeFi oversight.

- Consumer protection and enforcement are central, with a crackdown on scams, risky custody practices, and stronger public education efforts.

- Stablecoins and DeFi tools flagged for potential systemic risk, while anti-money laundering efforts and cross-agency coordination are being strengthened.

- Congress is being asked to pass new laws, especially around stablecoins and asset definitions, while a proposed federal crypto reserve was left out of the roadmap.

The post White House Lays Out Detailed Crypto Policy Blueprint appeared first on 99Bitcoins.